What is Property De-enveloping?

IN CERTAIN CIRCUMSTANCES IT MAY BE POSSIBLE TO AVOID SDLT & ATED TAXES WHEN DE-ENVELOPING!

WHAT IS DE-ENVELOPING?

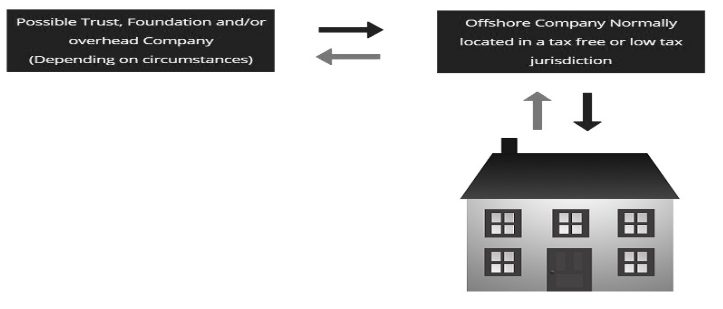

In simple terms, de-enveloping a property is when an individual, trust or otherwise decide to directly own a property rather than own it through a corporate vehicle normally registered in a tax free or low tax jurisdiction. The use of what are colloquially called ‘offshore’ companies to own both residential and commercial properties in the UK (primarily in or around the London area) started many decades ago due to the then significant tax advantages available to non-domiciled individuals whether they were or were not ordinarily resident in the UK.

Without becoming too technical or discussing the cumulative changes to UK legislation (primarily over the last decade) the ‘historic’ tax benefits of using an offshore company were extremely attractive for both the non-domiciled UK based community and foreign based investors wishing to purchase UK property. The advantages of using an offshore company could (depending on specific circumstances) have included:

- The legal avoidance of capital gains tax on the sale of the property;

- The legal avoidance of stamp duty land tax (SDLT) where shares in the offshore company were exchanged by suitably qualified individuals;

- The legal avoidance (were pertinent) of inheritance taxes (IHT)

- Asset protection from 3rd party litigation

In short, there is no doubt that the UK was until relatively recently an extremely attractive place for the international wealthy to both invest and live in with the UK’s traditionally very lenient and attractive tax treatment of non-doms having played no small part in making London the natural habitat of the world’s mega-wealthy. At the time of writing, July 2023, there still remain certain tax benefits for the international wealthy but it is certain that these remnants from more ‘tax friendly’ times will be whittled away until extinct probably within the next 5 -10 years.

EVERYONE WITH AN EXPENSIVE UK PROPERTY OWNED BY A COMPANY SHOULD SEEK ADVICE ON WHETHER IT IS ECONOMICALLY POSSIBLE TO DE-ENVELOPE

As predicted, the historic tax benefits and/or shelters offered to non-domiciled but ordinarily UK resident individuals (NDOR’s) has been whittled away but still exist for those willing or able to pay HMRC for an annual exemption. However, when it comes to residential property the tax benefits that once existed for properties owned by international companies are no longer available. Further, as a result of the introduction of an Annual Tax on Enveloped Dwellings (ATED), residential property ownership (save where prescribed exemptions exist) has become extremely expensive. The result is that many owners now want to de-envelope their properties but – without specialist knowledge and advice – hit a Stamp Duty Land Tax (SDLT) wall, which literally means that whilst de-enveloping is perfectly possible the costs of doing so could literally run into hundreds of thousands of Pounds! Fortunately, there are firms such as SCF and specialist legal firms that can, in certain circumstances, de-envelop a property and legally avoid SDLT whilst also removing the extremely expensive annual costs of paying ATED.

THE ANNUAL TAX ON ENVELOPED DWELLINGS (ATED) APPLIES TO PROPERTIES WORTH AS LITTLE AS £500,000.00

Most individuals/beneficial owners of a UK residential property worth over £500,000.00 will prima facie now find themselves not only liable for the upkeep of their offshore company but are also required to register and pay for an annual tax on enveloped dwellings (ATED) within 30 days of the beginning of the first day of the applicable charging period. Thus, for example a chargeable period commencing from the 1st of April 2023 would require that the ATED is paid by the 30th of April 2023 or penalties would be imposed. The ATED rate varies from £4,150.00 to £269,450.00 per annum (See Chart ‘A’) not to mention exposure to the previously avoidable capital gains and inheritance taxes. In short, it would save for one crucial fact seem self-evident that nearly all non-commercial properties individually* worth over £500,000.00 owned by offshore companies should seek to de-envelop. However, as said above, the fly in the ointment is that the process of conveying a property – a legally separate limited liability entity to its owner – triggers stamp duty land tax (SDLT) which in the UK is extremely punitive (See Chart ‘B’) and in effect creates a double SDLT taxation exposure to the same ultimate beneficial owner for the same property! More to the point, current anti-avoidance provisions and in particular the relatively recent ‘substance over form’ General Anti-Abuse Rule (GAAR) mean that any conveyance must be at verifiable market value if it is to stand up to scrutiny. There are of course HMRC reliefs and exemptions but to receive these an application must be made to HMRC showing that the offshore company is involved in a commercial enterprise in the UK subject to UK corporate and related taxes. This requirement in effect means that should an offshore company wish to apply for any reliefs and/or exemptions it would need to first register as a branch in the UK and then show it is a property development company holding stock, a qualified property rental company and/or has let out its property/ies on a commercial basis to a 3rd party at market rates.

HOW TO LEGALLY DE-ENVELOPE & AVOID DOUBLE SDLT EXPOSURE

This seems like ‘Having your Cake and Eating it’ but for many offshore companies (but not all unfortunately) it is possible to re-structure a company’s articles or their equivalent to allow distributions to be made to shareholders in a manner that does not trigger an SDLT charge. However, the process is not easy and involves an intricate legal procedure, many ‘Companies House’ or its equivalent submissions, the use of specialist lawyers in the offshore and the UK jurisdiction, legal opinions, official declarations, transfer of ownership (if nominees have been used) to the individual beneficial owners, up-to-date accounts from a qualified accountant, confirmation that the relevant company has sufficient assets to make the distribution and most importantly that there are no 3rd party creditors and/or debts owed and/or being paid form the distribution. There can also be further difficulties where properties are leasehold rather than freehold due to the addition of extra parties but these difficulties are more bureaucratic/procedural rather than absolute obstacles. As can be imagined, this type of process is very intensive but the end result is that a property can be transferred to its ultimate beneficial owner for a fraction of the cost of the otherwise applicable SDLT charge.

THE MORE VALUABLE THE PROPERTY TO BE DE-ENVELOPED THE CHEAPER THE PROCESS

As many of the costs, professional fees, disbursements and statutory lodgements are the same no matter the value of the residential property the economic sense of de-enveloping a property increases with the value of property. This means that whilst it can make economic sense to de-envelop a property worth £750,000.00 it makes even more sense if the property is worth £2 or £5 million as the savings become much greater given the sliding scale of SDLT charges (See Chart ‘B’ below).

Chart ‘A’ – ATED for 1st of April 2023 to the 31st of March 2024

| Property value | Annual charge |

| More than £500,000 but not more than £1 million | £4,150.00 |

| More than £1 million but not more than £2 million | £8,450.00 |

| More than £2 million but not more than £5 million | £28,650.00 |

| More than £5 million but not more than £10 million | £67,050.00 |

| More than £10 million but not more than £20 million | £134,550.00 |

| More than £20 million | £269,450.00 |

Chart ‘B’ – SDLT Rates

Freehold sales and transfers

You can also use this table to work out the SDLT for the purchase price of a lease (the ‘lease premium’)

| Property or lease premium or transfer value | SDLT charge |

| Up to £250,000.00 | Zero SDLT |

| From £250,001.00 to £925,000.00 (i.e. £675,000.00) | 5% SDLT |

| From £925,001.00 to £1,500,000.00 (i.e. £575,000.00) | 10% SDLT |

| The remaining amount (The proportion above £1,500,001.00) | £12% SDLT |

It should be noted that where a company (normally offshore) has a portfolio of investment properties then ATED shall only apply to such individual properties that are valued above £500,000.00 even. Therefore, even if the total value of a portfolio was £10 million provided none of them was valued over £500,000.00 then ATED – in such circumstances – would not apply. However, given that most offshore companies have been used to purchase London properties finding oneself outside of the ‘clutches’ of ATED is rare.

PRIORITY ENQUIRY FORM

(Strictly Confidential No Obligation)

SCF Legal & Corporate Management Services Limited

Address: 250 Kings Road, Chelsea, London SW3 5UE

Telephone: 020 7731 2020 Email: enquiries@scfgroup.com

Registration number: 05462416

A FULL RANGE OF LEGAL, ACCOUNTANCY & COMPANY MANAGEMENT SERVICES

The SCF International specializes in providing accountancy and management services for UK and Irish limited companies, UK & Irish company management services including the provision of (where necessary) domestic directors, domestic company secretaries, registered office address services, trading offices, value added tax (VAT) registration and management, payroll (Pay as You Earn PAYE), opening up and managing UK or Irish bank account facilities, raising invoices and any and/or all other services required to establish a bone fide managed and controlled UK or Irish limited liability company.

Our in-house team of legally and accountancy qualified experts can also provide advice on current UK & Irish tax laws/provisions including anti-avoidance provisions, EU directives and regulations, the impact of BREXIT for both UK and EU based businesses and other relevant. In addition, where required the SCF Group can also set-up and arrange the management of companies in tax efficient EU based jurisdictions such as Cyprus, Luxembourg or Malta or indeed any jurisdiction in the world including those in the Middle and Far East.

Property de-enveloping services – In conjunction with leading UK firms of solicitors SCF can help transfer companies currently held by what were known as ‘offshore’ companies into either more tax efficient UK companies or directly back into the names of individual beneficial owners’ often without attracting stamp duty land tax (SDLT) but still avoiding the advance tax on enveloped dwellings (ATED).

Our fiscal migration and tax planning department is operated by qualified lawyers and accountants and can advise both domiciled and non-domiciled individuals on how to mitigate their individual and corporate tax exposure be it in the UK or abroad. Our legal & business department can provide specialized advice on all domestic and international tax planning issues but also upon ‘key’ issues such as asset protection be it in the form of trusts and private interest foundations (PIF’s). In particular, SCF can provide advice to those intending to relocate to the UK on how to do so in the most tax efficient way.